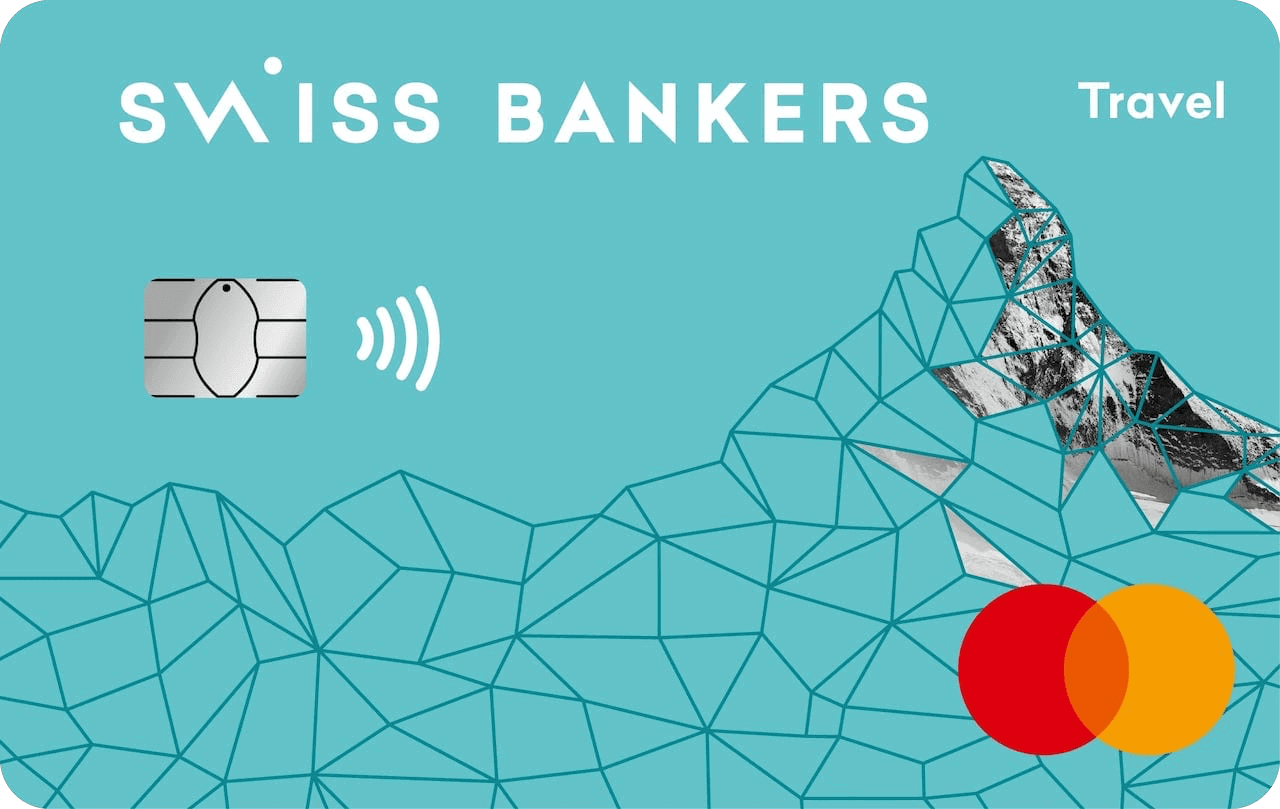

The best prepaid credit cards

Find the right prepaid credit card for your needs – secure, without a credit check, and compatible with digital payment systems. Whether for travel, teenagers, or everyday use: we show you the available options and how to easily apply for the best card.